Navigating the Taxation Maze: A Guide for Irish Nationals in the U.S.

Introduction

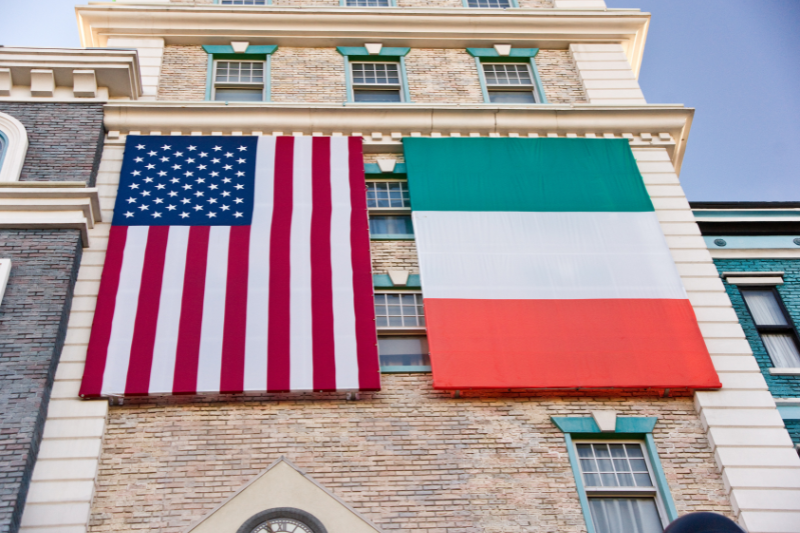

For Irish nationals making their home in the United States, the dream of a new life comes with its fair share of bureaucratic hurdles, none more daunting than navigating the twin titans of the U.S. and Irish tax systems. The complexity of fulfilling tax obligations in two countries simultaneously cannot be understated. With the United States’ policy of taxing residents on their global income, Irish expatriates find themselves in the unique position of having to file tax returns not just in their host country but also back home. This situation, ripe for the risk of double taxation, calls for a nuanced understanding of the U.S.-Ireland Tax Treaty—a beacon of guidance designed to prevent the financial strain of being taxed twice on the same income. This article aims to demystify this complex landscape, offering Irish nationals in the U.S. a comprehensive guide to managing their tax liabilities efficiently.

I. Understanding the U.S.-Ireland Tax Treaty

At the heart of the effort to ease the tax burden on Irish nationals in the U.S. lies the U.S.-Ireland Tax Treaty. Established to foster economic cooperation and to prevent double taxation, this treaty is a critical tool for those navigating the choppy waters of transatlantic taxation.

Purpose and General Provisions

The treaty outlines specific measures to eliminate the risk of an individual being taxed by both jurisdictions on the same income. It specifies which taxes are covered, defines residency for tax purposes, and lays out the framework through which taxpayers can claim benefits. Understanding these provisions is the first step toward leveraging the treaty to one’s advantage.

Double Taxation: The Core Issue

Double taxation is more than a mere inconvenience; it’s a significant financial burden. The U.S.-Ireland Tax Treaty addresses this by delineating the taxing rights of each country on various types of income, whether from employment, business profits, or investments. For Irish expatriates, this means the possibility of claiming exemptions or credits for taxes paid to one country when calculating their tax due in the other.

II. Residency Rules and Their Impact on Taxation

The question of residency is pivotal in determining one’s tax obligations. The United States employs two primary tests to ascertain tax residency: the Substantial Presence Test, which considers the number of days an individual has spent in the U.S. over a three-year period, and the Green Card Test, which applies to lawful permanent residents.

U.S. Tax Residency Rules

Understanding these tests is crucial for Irish nationals who must navigate the complexities of being considered a tax resident in the U.S. while potentially retaining tax obligations in Ireland. The implications of U.S. residency extend beyond where one pays taxes, affecting worldwide income and necessitating a strategic approach to tax planning.

Irish Tax Residency Criteria

Conversely, Ireland determines tax residency based on the amount of time spent in-country during a tax year and across a look-back period. Irish nationals in the U.S. need to understand these criteria to manage their tax status in Ireland effectively, particularly when it comes to income that might be subject to tax in both countries.

Managing Dual Residency Status

For those caught between the tax systems of both countries, strategic planning can mitigate the risks and burdens. This section will delve into how to navigate dual residency status, emphasizing the importance of timing, the strategic recognition of income, and the utilization of treaty benefits to reduce overall tax liability.

Navigating the tax landscape as an Irish national in the U.S. is undoubtedly complex, but with the right knowledge and strategies, it’s a manageable challenge. The U.S.-Ireland Tax Treaty stands as a testament to international cooperation, offering a pathway to financial efficiency and fairness for expatriates caught between two tax regimes. By understanding the intricacies of residency, global income taxation, and the mechanisms in place for preventing double taxation, Irish expatriates can position themselves to navigate these challenges successfully. However, the ever-evolving nature of tax law and individual circumstances recommend a cautious approach, one ideally supplemented with professional advice. As we’ve explored the critical aspects of this unique tax situation, it’s clear that with careful planning and a proactive stance, the hurdles of cross-border taxation can be overcome, leaving Irish nationals free to pursue their American dream without undue financial burden.

Continuing from the discussion on the intricacies of residency and its impact on taxation for Irish nationals in the U.S., let’s dig deeper into the specific challenges and strategies related to global income taxation, foreign earned income exclusions, tax credits, and the importance of professional guidance.

III. Global Income Taxation in the U.S.

The principle of global income taxation underpins the U.S. tax system, requiring all residents (including Irish nationals who meet the residency criteria) to report and pay taxes on their worldwide income. This broad scope includes not only wages and salaries but also investment returns, rental income, and business profits, regardless of where these incomes are generated.

The Importance of Reporting Global Income

For Irish expatriates, the obligation to report global income to the IRS means that careful record-keeping and comprehensive financial planning become paramount. Understanding which types of income must be reported and the applicable deductions and credits can significantly impact one’s tax liabilities and opportunities for savings.

IV. Foreign Earned Income Exclusion and Tax Credits

A pivotal aspect of managing U.S. tax obligations for Irish nationals is navigating the Foreign Earned Income Exclusion (FEIE) and claiming Foreign Tax Credits (FTC). These provisions can offer relief from double taxation but require a nuanced understanding of eligibility and application.

Foreign Earned Income Exclusion (FEIE)

The FEIE allows qualifying U.S. taxpayers living abroad to exclude a certain amount of their foreign earned income from U.S. taxation. Understanding the eligibility criteria, such as the physical presence or bona fide residence tests, and how to properly claim this exclusion, is crucial for Irish nationals seeking to minimize their U.S. tax burden.

Foreign Tax Credits (FTC)

For income not excluded under the FEIE, the FTC offers a way to offset U.S. tax liabilities with taxes paid to foreign governments, including Ireland. Navigating the calculation and application of these credits demands a detailed understanding of both U.S. and Irish tax payments, ensuring that credits are maximized and double taxation is avoided.

V. Navigating Tax Liabilities with Professional Help

Given the complexity of the U.S. and Irish tax systems, seeking the advice of tax professionals who specialize in expatriate taxation becomes not just beneficial but often necessary.

The Role of Tax Professionals

Tax advisors with expertise in both U.S. and Irish tax laws can provide invaluable guidance, from determining residency status and taxable income to optimizing the use of treaties, exclusions, and credits. They play a crucial role in developing strategies that comply with legal requirements while minimizing tax liabilities.

Choosing the Right Tax Advisor

Selecting a tax professional should be done with care, focusing on their experience with expatriate tax issues, familiarity with the U.S.-Ireland Tax Treaty, and a track record of helping clients navigate similar challenges. This section would provide insights into what to look for in a tax advisor and how to establish a productive working relationship.

For Irish nationals living in the United States, mastering the complexities of the tax systems in both countries is a formidable but surmountable challenge. By leveraging the U.S.-Ireland Tax Treaty, understanding the nuances of residency and global income taxation, and making strategic use of exclusions and credits, Irish expatriates can navigate their tax obligations more effectively. The role of knowledgeable tax professionals in this process cannot be overstated, offering tailored advice and strategies that ensure compliance while optimizing tax outcomes.

This exploration underscores the importance of proactive tax planning and informed decision-making for Irish nationals in the U.S., ensuring that their American dream is not diminished by the complexities of cross-border taxation. With the right approach and expert guidance, the tax maze becomes navigable, allowing Irish expatriates to focus on building their lives and careers in the United States with confidence and financial savvy.

- Planning and Compliance for Irish Expatriates: Incorporating Tax Efficiency in Investment Planning

Tax compliance and strategic planning are indispensable for Irish nationals in the U.S., serving as the bedrock for navigating the intricate dual tax obligations effectively. A profound comprehension of both U.S. and Irish tax systems empowers expatriates not only to adhere to compliance requirements but also to refine their tax positions, optimizing overall financial health.

Best Practices for Tax Compliance

The cornerstone of financial stability for Irish expatriates is the rigorous maintenance of tax compliance across both jurisdictions— the U.S. and Ireland. This commitment involves the punctual and precise submission of tax returns, supported by comprehensive documentation to substantiate claims for deductions, exclusions, and credits. Critical attention must be paid to reporting obligations for foreign bank accounts and assets, mandated by the FBAR (Foreign Bank and Financial Accounts Reporting) and FATCA (Foreign Account Tax Compliance Act) regulations in the U.S., ensuring transparency and adherence to international tax laws.

Strategic Tax Planning: A Pathway to Tax Efficiency

Strategic tax planning transcends basic compliance, embracing the structuring of financial affairs to minimize tax liabilities, all within the legal framework. For Irish expatriates, this strategic planning includes meticulous decisions regarding investment locations, remittance structuring, and the timing of significant financial activities to leverage favorable tax treatments under the U.S.-Ireland Tax Treaty.

Tax Efficiency in Investment Planning

Diversification Across Jurisdictions: Diversifying investments across different jurisdictions can mitigate risk and leverage tax advantages specific to each country. Irish nationals should consider the tax implications of holding investments in the U.S. versus Ireland, balancing growth potential against tax liabilities.

Utilizing Tax-Advantaged Accounts: Expatriates should explore tax-advantaged investment accounts in the U.S., such as IRAs (Individual Retirement Accounts) and 401(k)s, which offer tax-deferred growth or tax-free withdrawals, depending on the account type. Similarly, understanding and utilizing Ireland’s tax-efficient investment vehicles can significantly enhance an investment portfolio’s after-tax return.

Harvesting Tax Losses: Tax loss harvesting or selling investments at a loss to offset capital gains tax liabilities, can be an effective strategy for managing investment taxes. This approach requires careful coordination between U.S. and Irish tax obligations to maximize benefits.

Understanding the Impact of the U.S.-Ireland Tax Treaty on Investments: The treaty provides specific rules on the taxation of dividends, interest, and royalties, potentially reducing withholding tax rates. Investors should familiarize themselves with these provisions to optimize their investment income’s tax treatment.

Estate Planning Considerations: Irish nationals must consider the estate tax implications of their investments, particularly in the U.S., where estate taxes can be significant. Structuring investments with an understanding of both U.S. and Irish estate tax laws is crucial for effective wealth transfer planning.

For Irish nationals navigating the complex financial landscape of living in the U.S., integrating tax efficiency into investment planning is a critical element of achieving financial success. Through diligent compliance, strategic tax planning, and a holistic approach to investment decisions, expatriates can significantly enhance their tax positions. By leveraging the opportunities presented by the U.S.-Ireland Tax Treaty and understanding the tax-efficient investment strategies available, Irish expatriates can optimize their financial well-being while ensuring adherence to the tax laws of both countries.

Author: Ben Buckley

Tel: +971 56 955 1328, +353 83 148 0637

Email:[email protected]

[email protected]

Advisory services in the United States are offered and provided through Beacon Global Advisory Network, LLC, a registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training and does not imply endorsement by the Securities and Exchange Commission (SEC) or any state. No promises or guarantees are offered that you will attain your financial or investment goals or objectives.