When it comes to investment options there are plenty for potential investors to choose from. The asset classes include cash, bonds, real estate, commodities, and equities.

Deciding on which is best investment for an individual will depend on several factors including:

- Your investment horizon

- Financial goals

- Desired level of returns

- Access needs

- Risk profile and Capacity for loss

- Personal preferences based on your own experience and morals.

So which option provides the best returns over the long term.

Investing in the stock market is a great way to generate a real return after taxes and inflation over a long term.

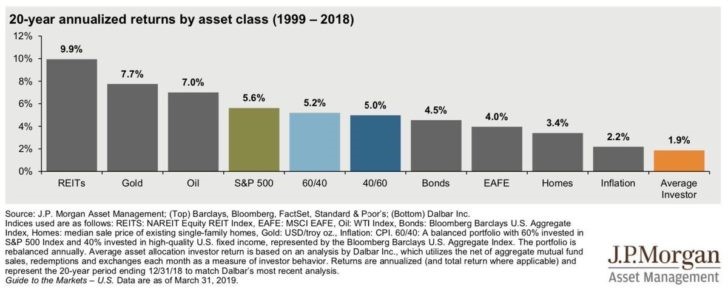

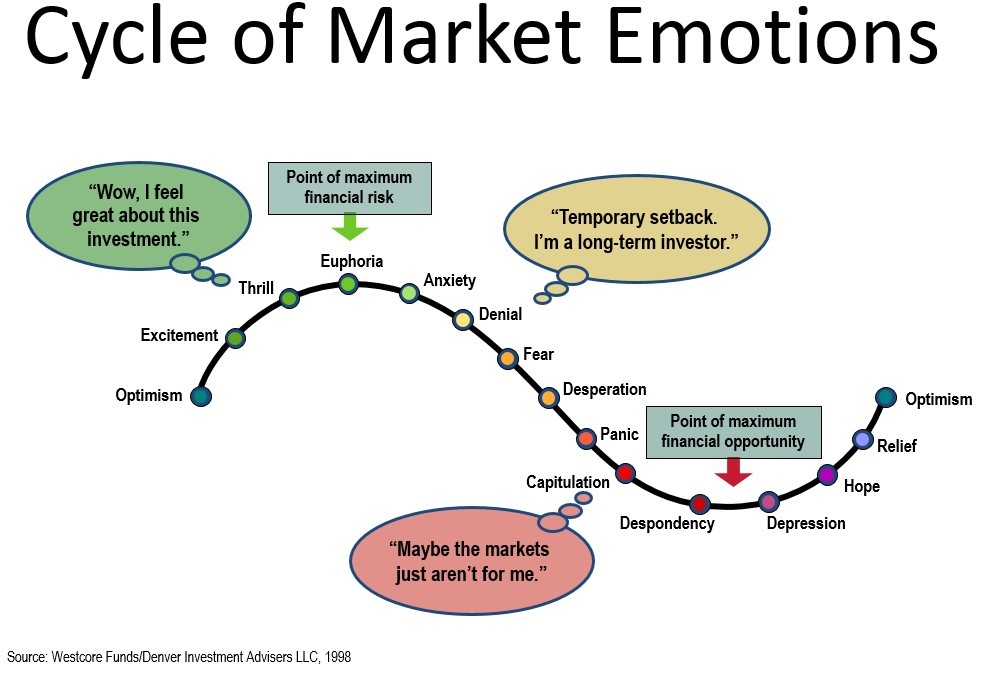

The danger comes when investors try to time the market, based on their emotions and the market position. As shown above the average investor produced 1.90% over 20 years, during a period when the S&P500 averaged 5.60%. The main reason for this difference is making emotional decisions to try time the market.

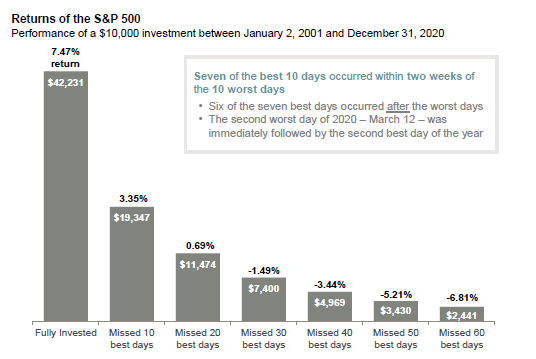

Investors generally sell when the market is down and do not realise that the best plan of action is to investment. As shown in a recent JP Morgan report on Retirement the impact of missing just a few days over a 20-year period can have devastating consequences on your investment returns.

The message is simple. Investment for the long term will generate real returns but chasing the returns by trying to time the market will lead to disappointment.

If you want more information on this topic or would like to speak to me about any investment or savings strategy, please contact me in the links provided.

Author: Ben Buckley

Tel: +971 56 955 1328, +353 86 3345684

Email: [email protected]